The Quiet Giants: Why Infrastructure Startups Have Dominated the Recent IPO Landscape

While consumer apps and SaaS companies often grab the headlines, a different story has been unfolding in the public markets since 2017. Infrastructure companies have been quietly but decisively outperforming their application-layer counterparts, creating some of the most valuable technology companies of the past decade.

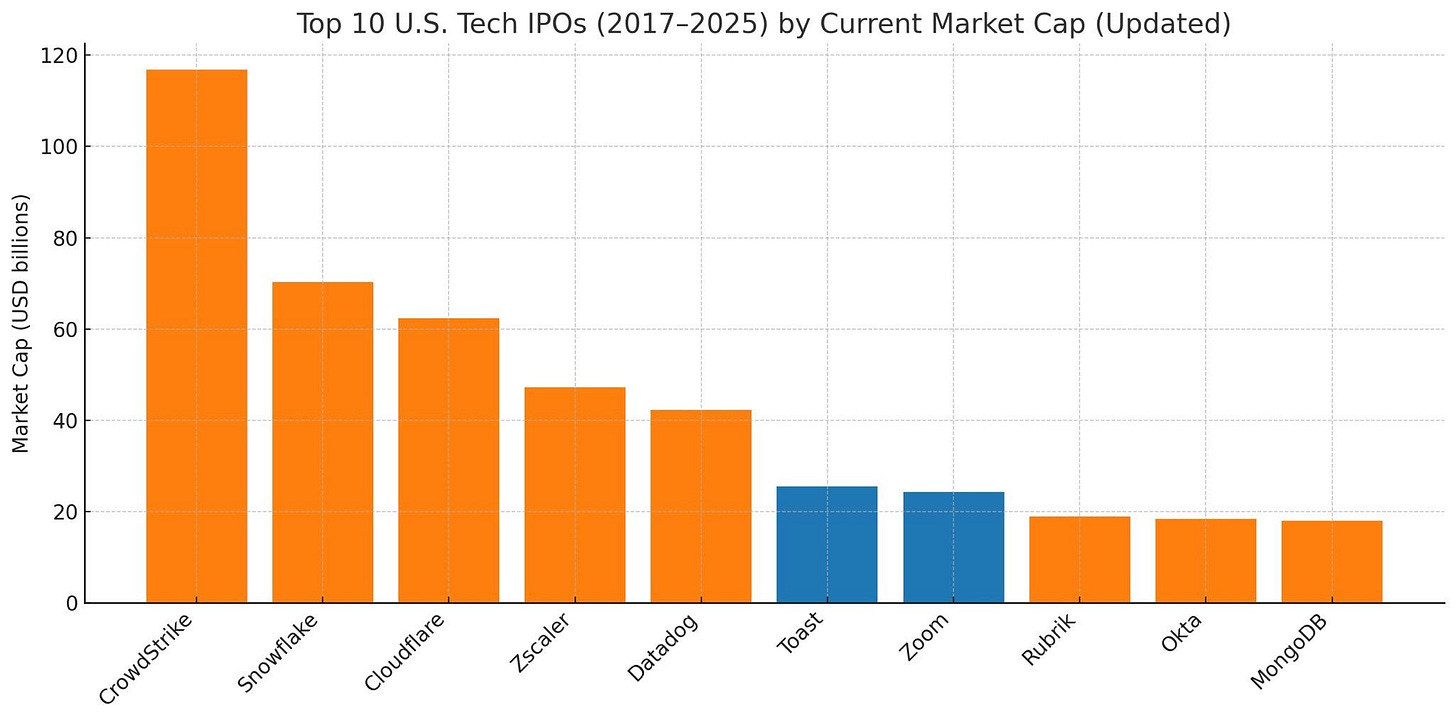

Look at the top IPO performers: CrowdStrike, Snowflake, Cloudflare, Zscaler, Datadog, Rubrik, Okta, and MongoDB. What do they have in common? They all build critical infrastructure that powers the modern digital economy. And their success isn't accidental—it's the result of navigating a brutally difficult path that leads to outsized rewards.

The Infrastructure Gauntlet: Why Building Is So Hard

Infrastructure startups face challenges that would break most companies. Unlike building a consumer app or business SaaS tool, infrastructure requires:

Deep Technical Excellence: These aren't weekend hackathon projects. Infrastructure companies need years of deep-tech R&D and significant upfront capital expenditure before they have anything resembling a sellable product. The technical bar is unforgiving—your solution needs to be not just good, but exceptional.

Marathon Sales Cycles: While a SaaS company might close deals in weeks, infrastructure vendors endure 6-12 month pilots with extensive proof-of-concept phases. Enterprise buyers don't switch their foundational systems lightly. Add complex compliance requirements and security audits, and you're looking at sales cycles that can stretch over a year.

The Talent Equation: Building world-class infrastructure requires rare engineering talent—the kind that big tech companies fight over with seven-figure packages. And it's not just about coding skills. You need engineers who understand distributed systems, security, performance optimization, and can think in terms of five-nines reliability.

Extreme Trust Requirements: When you're asking companies to bet their entire operation on your infrastructure, trust isn't nice to have—it's existential. One major outage or security breach can end your company overnight.

Most startups stall out before achieving true product-market fit in infrastructure. The graveyard is littered with technically impressive solutions that couldn't navigate these challenges.

The Infrastructure Advantage: Why Winners Win Big

But here's the paradox: those who survive the gauntlet find themselves in an enviable position. Infrastructure winners don't just succeed—they dominate.

Becoming the Default: Once you're embedded in a company's infrastructure, you literally live in the plumbing. You become the default choice not through marketing, but through indispensability. When everything runs on your platform, switching isn't just expensive—it's existentially risky.

The Expansion Flywheel: Infrastructure naturally expands. Start with one use case, prove value, then watch as usage spreads across departments and workloads. Each new application built on your platform increases switching costs exponentially. It's not uncommon to see net revenue retention rates of 130-150% in successful infrastructure companies.

The Margin Magic: Here's what most people miss—infrastructure gross margins improve dramatically at scale. Unlike human-intensive services, infrastructure leverages shared resources across customers. As you grow, those heavy upfront investments amortize across a larger base, transforming these companies into cash-generating machines. Snowflake's 75% gross margins tell the story.

The Proof Is in the Numbers

The market is validating this thesis with extraordinary valuations:

Cybersecurity Infrastructure: The speed of value creation here is breathtaking. Wiz, Cyera, and Chainguard are all less than 5 years old, yet command enterprise values between $4-30 billion. Why? Security budgets are compounding at 15-20% annually as every company becomes a software company—and every software company becomes a security company.

Data & Cloud Infrastructure: Snowflake went public in 2020 and now trades at roughly $70 billion. CrowdStrike, IPO'd in 2019, sits at approximately $117 billion. The TAM (Total Addressable Market) for these companies grows with every new cloud workload, every new data source, every new application that needs their services.

AI Infrastructure: We're witnessing history in real-time. OpenAI at ~$300 billion and Anthropic at ~$61 billion aren't just unicorns—they're tracking to become some of the most valuable companies ever created. The AI infrastructure layer is creating value at a pace we've never seen before.

The Pattern for Massive Outcomes

The formula is consistent across all these winners:

🏗 Hard Build: Years of technical development, massive capital requirements, and patience through multiple iterations.

📈 Steep Adoption: Once product-market fit hits, adoption curves go vertical. The pent-up demand for better infrastructure creates explosive growth.

🔒 Durable Moat: High switching costs, network effects, and continuous innovation create defensibility that's nearly impossible to breach.

💰 Massive Outcome: The combination of large markets, pricing power, and improving unit economics creates extraordinary outcomes.

The Bottom Line

For founders and investors willing to embrace the challenge, infrastructure represents one of the few remaining areas in tech where you can build truly enduring value. Yes, it's harder. Yes, it takes longer. Yes, it requires more capital and more patience.

But the companies that successfully navigate infrastructure's brutal early cycles don't just win—they become the foundational layer that entire industries rely on. In a world increasingly built on software, owning the infrastructure layer isn't just a good business. It's the best business.

The quiet giants of infrastructure aren't so quiet anymore. They're reshaping how we build, secure, and scale the digital economy. And they're just getting started.